References from Former Employers

When you’re in the home stretch of applying for a job, potential employers will often ask for references to get additional background on your job history and performance. For job applicants, it’s important to choose references who are willing to provide a recommendation — some businesses will only verify employment dates, but ideally a reference will provide some information on why the applicant would be a good fit for a new role. Some job seekers use a professional reference checking service to find out what information a particular reference might offer, and to help them choose which references to list on a resume.

Companies that are in the process of hiring employees can get permission from applicants to check their references during the interview stage. When contacting references by phone, it’s important to be prepared with specific questions or a script to follow to save time and ensure consistency, and to check with the referee first to see if they have time to talk. While there may be a standard company procedure for checking employment references, it can help to customize the questions on your reference template to match the requirements of each specific job. Here are some basic items commonly included in an employee reference check form:

- Job title for the current position

- Former employer contact information

- The referee’s relationship to the applicant

- Verification of employment dates

- Salary earned in previous position

- Specific questions about job performance, skills, and social aptitude

- Applicant strengths and weaknesses

- Eligibility to be rehired by former employer

- Reason for leaving previous job

- Any concerns or previous record of disciplinary actions

Once you collect information from the references and candidates complete interviews and other application procedures, hiring managers can make an informed decision about who to hire. Checking references may be time consuming, but it can save time, money, and hassles in the long run.

What Is a Bank Reference?

A bank reference provides information on how a company handles financial accounts and lines of credit. Companies, and often suppliers, will request a bank reference as part of their due diligence when opening up a line of credit for a new business customer to purchase goods or services.

What Is A Trade Reference?

Businesses often have to prove their creditworthiness in order to create an account with a supplier. In order to do so, they provide bank and trade references to show that they are able to make payments on time and have positive, ongoing relationships with current suppliers. It’s common for a company to request three trade references before agreeing to provide a customer with goods on credit. Note that quality trade references will come from businesses that are in the same industry.

Primary references are suppliers that provide the goods and services that a business depends on, such as materials, equipment parts, printing, or software development. Secondary references might come from service providers such as accountants or consultants. A service provider (such as a utility company) is generally not acceptable as a trade reference because utilities are more likely to be paid consistently in order to keep basic business functions operating.

In addition to checking trade references when starting a credit relationship, suppliers may request updated references if a customer is showing changes in buying patterns that could indicate cash flow issues. A trade reference will generally include the following information:

- A company’s experience with the customer (including the length of their relationship)

- Annual sales to the customer

- Credit terms

- The customer’s outstanding balance or late payment history

- Any legal notices or disclaimers that may need to be included

What Is a Credit Reference?

A credit reference provides information on how an individual or organization has handled credit, such as loans, credit cards, and other lines of credit. A formal report is typically conducted by a credit reporting agency, which provides a score based on payment history and other factors. A credit report is distinct from trade and bank references, as described above, which are also used to determine whether credit will be extended to a business by a supplier or lender.

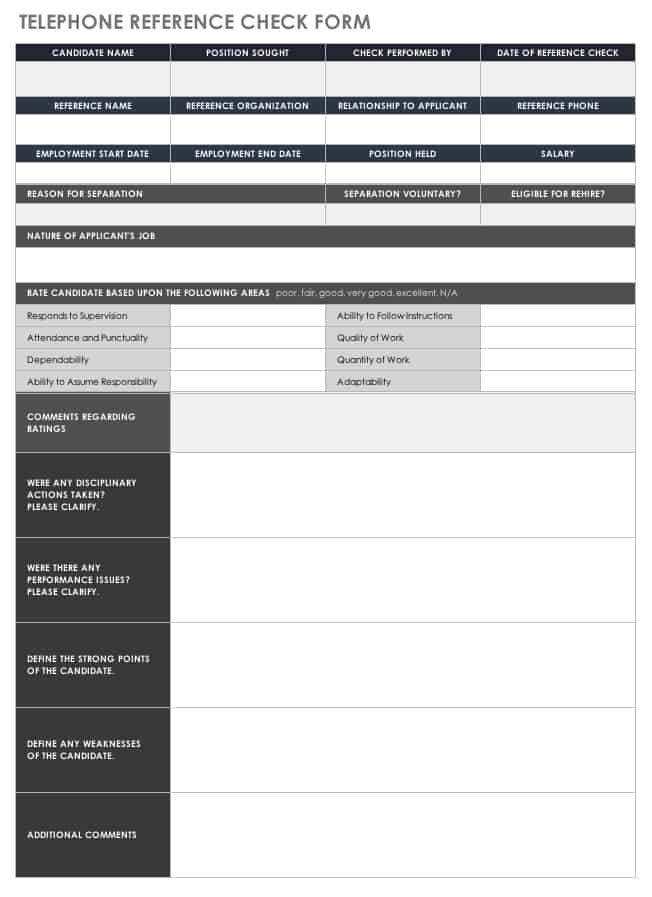

Telephone Reference Check Form

Create an employment reference form that you can use over the phone. This template provides a basic outline to follow, which you can customize to include questions and information required for a specific job. Include details such as who is conducting the reference check, the relationship of the referee to the applicant, qualities and skills that you want to rank, and any claims from a candidate’s resume that you want to verify.

Download Telephone Reference Check Form Template

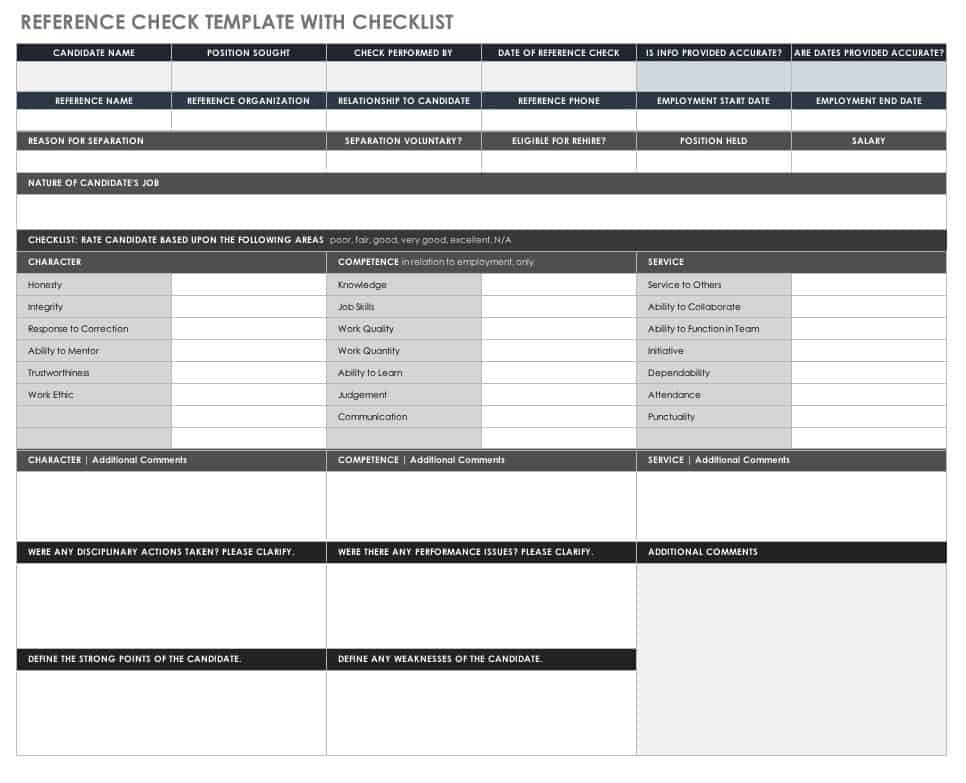

Reference Check Template with Checklist

This template provides a checklist format to help streamline the reference check process. A checklist makes it easy to provide quick answers to questions or to use a ranking scale for evaluating candidates. You can use this template to conduct a phone interview with a referee, or have them fill it out at their own convenience. Customize the template to include whatever questions and details are relevant to the position.

Download Reference Check Template with Checklist

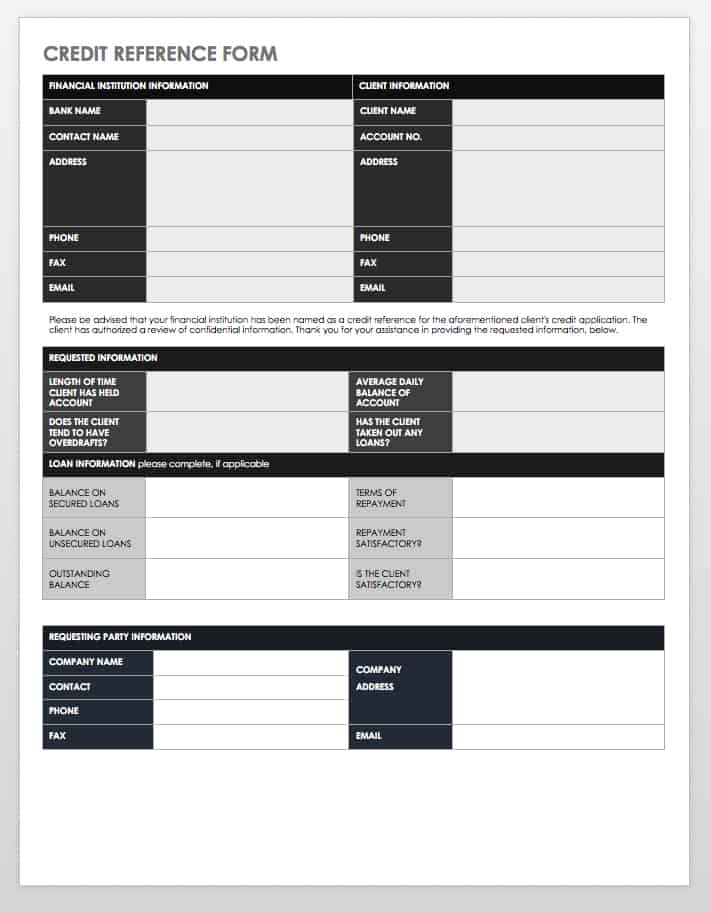

Credit Reference Form

This credit reference form allows customers to list bank and trade references for potential suppliers to contact. It provides sections for adding company information, including the type of business, bank details, and up to three trade references. Suppliers can use this template to collect references and determine the creditworthiness of a business.

Download Credit Reference Form

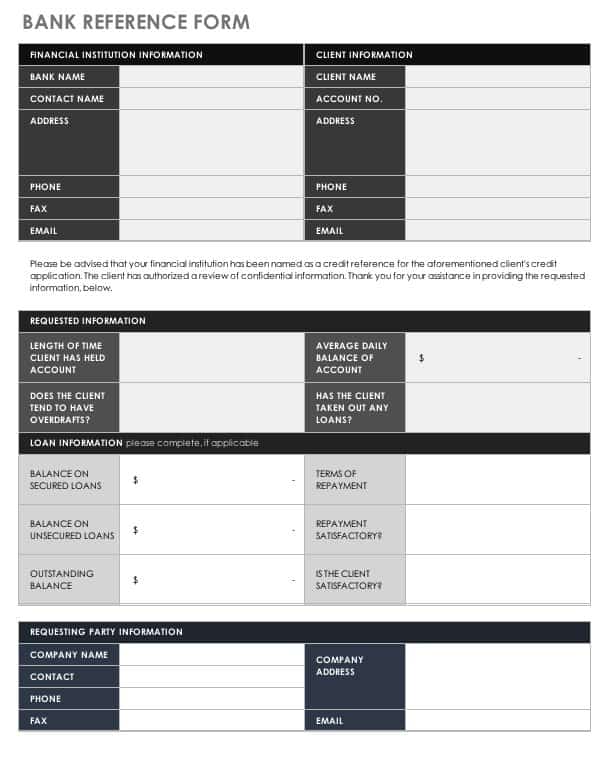

Bank Reference Form

Request bank credit information with this simple template. The form includes questions on loans, outstanding balance, and repayment information. Edit the template to match your needs, and check with your legal department for any additional information that may need to be included on the form.

Download Bank Reference Form

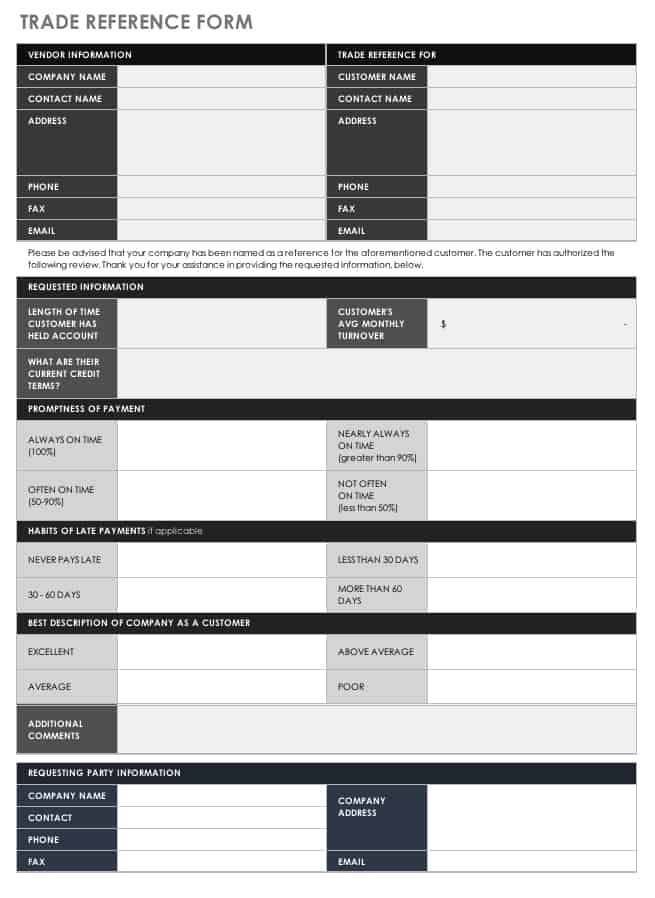

Trade Reference Form

This trade reference form provides key details on a customer’s credit terms, payment history, and overall performance. You can include specific questions as well as additional space for soliciting comments. This is a brief form for collecting information, and will save all parties time while providing critical information.

Download Trade Reference Form

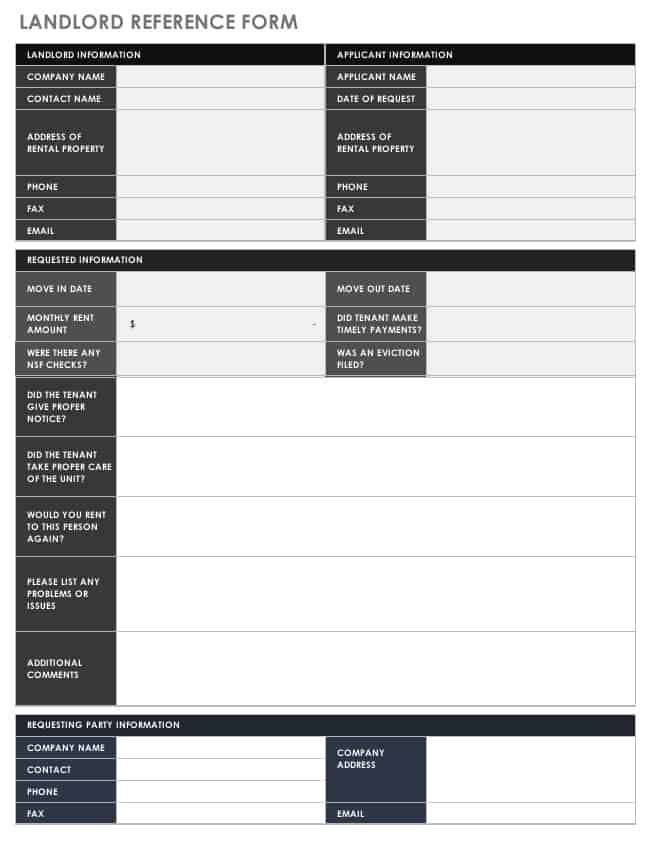

Landlord Reference Form

Landlords and property managers can use this rental reference form to verify a tenant’s history of making timely payments, caring for a unit, and following property rules. Former landlords can verify dates of tenancy and vouch for the renter or note any important issues, including eviction notices or property damage.

Download Landlord Reference Form

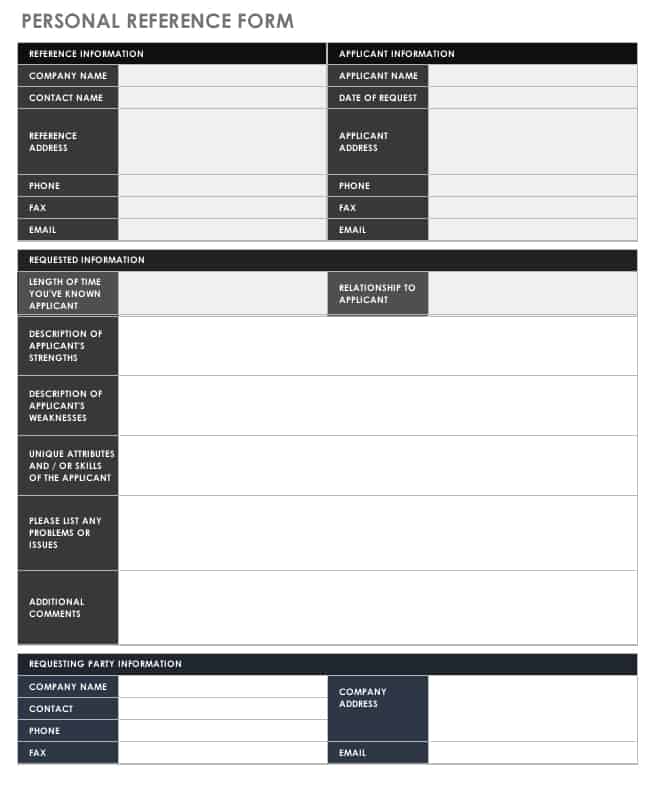

Personal Reference Form

Some employers request personal references, also known as character references, as part of a job application. A personal reference may also be needed when applying for an educational program or similar opportunity. This template identifies the type and length of relationship between the referee and the candidate, and it includes sections for comments on the candidate’s character and readiness for a given role.

Download Personal Reference Form

Manage Reference Forms with Work Management in Smartsheet

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.