What Are Pro Forma Financial Statements?

Pro forma financial statements present the complete future economic projection of a company or person. Often used to back up a lending or investment proposal, they are issued in a standardized format that includes balance sheets, income statements, and statements of cash flow. “Pro forma” literally means “as a matter of form.” In finance, this matter of form forecasts the future based on the present, using hypothetical budgeting. Pro forma data estimates are built in to show the company’s profits if certain, one-time items are taken out. Anything the company sees as a one-time only expense — or that does not show the company’s representative value — is removed. Instead of tracking the past exactly, such as would be reported in historical income statements, pro forma statements are used to guide big financial decisions, such as the following:

Debt Refinancing: How the short term is affected by refinance options.

One-Time Large Purchases: Purchases such as land or services, and how they affect the budget.

Company Mergers or Acquisitions: Complete as a part of due diligence to assess future business operating prospects and valuation. In startups, this is often a way to find venture capital.

Leases: How big leases, such as buildings or vehicles, will affect the budget with new accounting standards.

You can also use pro forma statements to do the following:

Develop various sales and budget projections.

Assemble results in profit/loss projections.

Translate data into cash flow projections.

Identify the company assumptions about their financial and operating characteristics.

Compare balance sheets.

Perform financial ratio analysis.

Make decisions about marketing, production, research, development, and projects.

Represent the financial picture of a company sans a specific program or department that may be floundering.

Show a more accurate picture of the company’s finance, as compared to GAAP or IFRS accounting frameworks.

Act as a benchmark.

Motivate your staff.

Used to show company results to investors, pro forma financial statements are often combined with generally accepted accounting principles (GAAP) adjusted statements. Pro forma financial statements are not computed using GAAP and are often called non-GAAP. GAAP-adjusted statements are uniform financial statements guided by rules of the Financial Accounting Standard Board (FASB). They differ from pro forma statements in that they are not projections, but rather historical reports — therefore, they do not consider things like litigation costs, restructuring charges, and other one-time items.

Pro forma analyses are meant to paint a better picture of what is happening with the company, irrespective of one-time events, but considering the specific industry’s standards. In some respects, this type of analysis is a more accurate depiction of the company’s financial health and outlook. Further, organizations may want to develop their pro forma financial statements while they are doing an annual review of their business plan.

Pro Forma Financial Statements and Regulation

The Securities and Exchange Commission (SEC), the United States’ regulator of its stock market, requires pro forma statements with any filing, registration, or proxy statement. They have articles governing the preparation of pro forma financial statements for public companies. These are Regulation S-X Article 11, and Regulation S-X 8-05 for smaller companies from 17 CFR 210. According to the SEC, pro forma financial statements will be prepared for public companies when something happens that the investors should know, such as in the case of an acquisition, jettison of a business, real estate transactions, roll-ups, spin-offs, changes in accounting principles, changes in accounting estimates, or corrections of previously made errors. Additionally, the SEC may require that pro forma financial statements be submitted when a company is filing for an initial public offering (IPO). This is also true of companies that change tax status from a private, nontaxable company to a taxable C-corporation to file for an IPO. The pro forma financial statements, including pro forma earnings per share calculated, must be submitted. Finally, if substantial changes to the firm’s capitalization (the sum of their stock, debt, and retained earnings) are assumed to change substantially after the offering’s close date, pro forma documents must reflect that.

A financial forecast may be used in lieu of pro forma financial statements. According to the SEC, this does not take the place of the pro forma balance sheet, but the pro forma income statement may be withheld. The difference is that the financial forecast details the company’s expected results of operations as a single-point estimate or a range. The legal liability of the company may increase upon submitting forecasts instead of pro forma income statements, but the practice may be more relevant for certain businesses.

Not only does the SEC regulate pro forma statements, but the FASB and the AICPA provide directives, especially when there are major changes in the business structure. To evaluate a new or proposed business structure in pro forma documents, these agencies say that the statements must conform with those of the predecessor business. For businesses that are going public and have to transform into a corporation, the predecessor business may not contain items relevant to a corporation, so the following adjustments must be made:

State the owners’ salaries as officers’ salaries.

Recalculate the federal taxes of the predecessor business as though it were a corporation.

Include corporate state franchise taxes.

Add the partner capital balance to the contributed capital instead of to retained earnings through pooling of interests.

Consider making pro forma provision for taxes that would have been paid if the company was a corporation in the past.

For businesses that previously acted as a partnership or sole proprietorship that are being acquired into a corporation, the statements must reflect that of the acquiring business. This includes that business’ net sales, cost of sales, gross profit on sales, expenses, other income and deductions, and income before taxes.

If a business is acquiring a new business or disposing part of its business, the pro forma statements need to adjust the historical figures to reflect this, and to show, in the case of an acquisition, what a corporation would have looked like separately, but added together. If possible, show a five year projection of the businesses together. There’s no need to include overhead costs. For the effects of the business combination, only show the current and immediately preceding periods.

Financial Modeling Based on Pro Forma Projections

Since pro forma financial statements and financial projections are quite similar, they may be considered synonymous. However, financial projections can be built from nothing for a startup company, using specific industry-specific assumptions. By contrast, pro forma financial statements are based on current financial statements and change based on events and assumptions. In other words, pro forma financial statements start from real financial data.

Compiled pro forma financial statements can form the basis for calculating financial ratios and financial models, which test assumptions and relationships of your company’s plan. You can use them to study how changes in the price of labor, materials, overhead, and the cost of goods affect the bottom line. Use these models to test the goals of a company’s plan, provide findings that may be understood, and offer better, more accurate data than other methods. New financial models use computer programs that has made this testing better, which enables quick calculation for real-time decision making.

Industries That Use Pro Forma

Industries that use pro forma as a concept, whether for financial statements or not, include the following:

Accounting: Pro forma financial statements are compiled for other companies to show the health or true picture of an organization when the GAAP statements are insufficient. Companies are cautioned against using pro forma to obscure GAAP statements.

Business: There are many uses in business for pro forma financial statements. Anytime a transaction is scheduled, such as a merger, acquisition, capital investment, or change in capital structure, pro forma is used as a projection. The pro forma shows the projected cash flow, net revenues, or taxes expected. The business plan will include pro forma financial statements that show the effect of the proposed change, project, or new business. Some banks require pro forma statements to verify cash flow prior to issuing a line of credit.

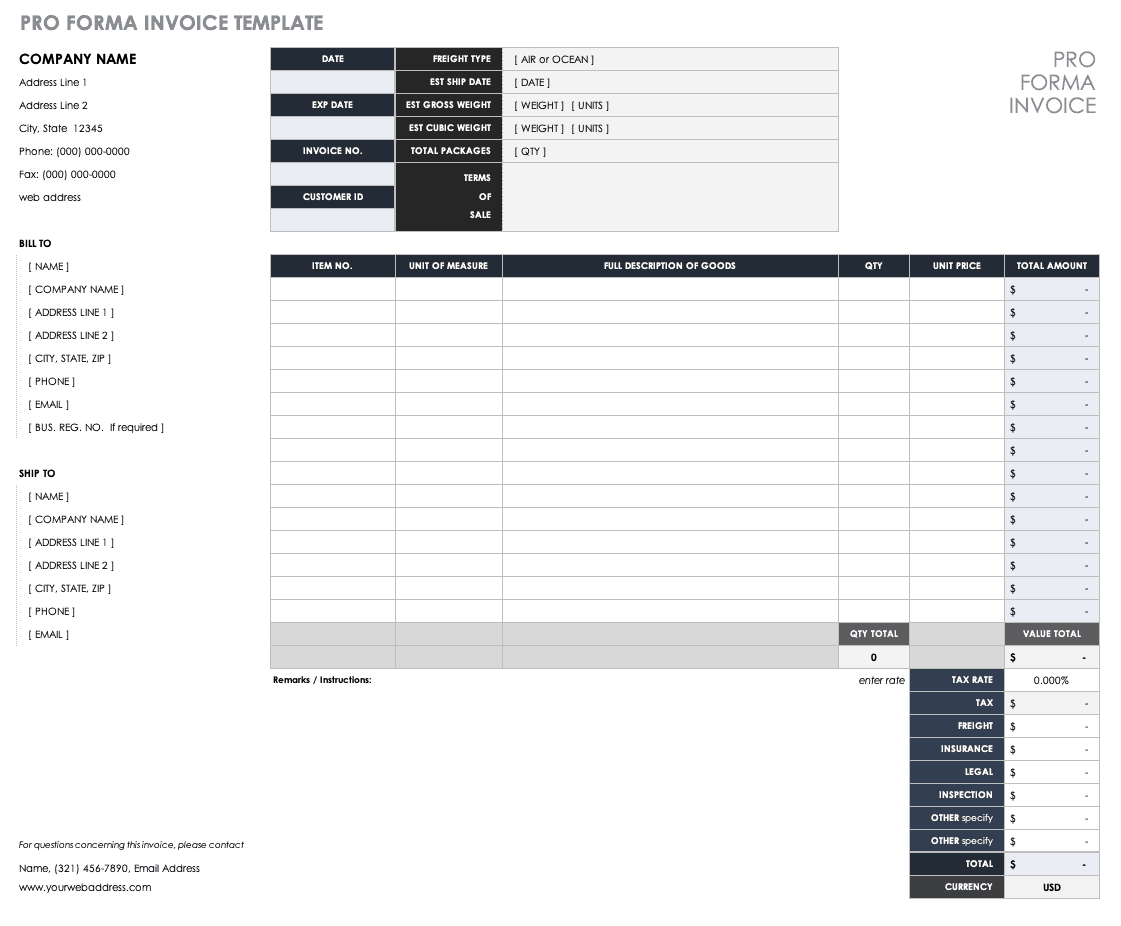

International Trade: When used in international trade, pro forma invoices are a declaration to customs authorities about the details of the transaction. A pro forma invoice is a precursory bill of sale for buyers that is sent before the delivery of goods or services. The statement is a binding agreement, not just a quote, although the terms may be subject to change. The sale price is often precise and includes commissions, fees, taxes, and shipping costs, and benefits the buyer, so that they are not exposed to major changes during the final transaction. The invoice is not a demand for payment or a bill. In the U.S., a commercial invoice must follow a pro forma invoice for customers within 120 days. Sometimes the use of these pro forma invoices is referred to as “on a pro forma basis.”

Use this Excel pro forma invoice template to create your own pro forma invoices.

Download Pro Forma Invoice Template

Law: In legal terms, pro forma means something that satisfies minimum requirements. Pro forma court rulings are made as formalities to facilitate the legal process.

Engineering: Pro forma drawings and templates are used to make agreements with customers and to project the financial basis of projects

Government: In Commonwealth systems, pro forma bills are first drafts of legislation that go through the reading stage. They are symbolic of the parliament’s right to discuss matters aside from those mandated by the head of state. They do not go further than the first reading. Pro forma bills are found in the United Kingdom, Canada, and Australia. In the United States, pro forma sessions are brief meetings of the Senate or House of Representatives. No votes are taken, and no legislative business is generally conducted during a pro forma session. Often, these sessions are held to ensure that both chambers of Congress uphold their requirement to meet every three days during a congressional session. Another reason these may be held is to ensure that the president does not make any recess appointments.

Problems with Pro Forma Analysis

Even though pro forma statements are meant to show a more accurate picture of the business’ profitability, there are many ways to manipulate the documents to give a more favorable representation, as there are no universal guidelines for their compilation. The following details are often left out of the pro forma:

Depreciation

Goodwill

Amortization

Restructuring and merger costs

Interest and taxes

Stock-based employee pay

Losses at affiliates

One-time expenses

Many of the items listed above are part of the GAAP, but not included in pro forma reporting, making it rife for possible deception. This discrepancy is part of the reason the distinction between pro forma and GAAP financial statements is important. Sometimes, in pro forma documents, unsold inventory is even excluded. Not all these things should be left off, but the decisions of what is left off should be well thought out and explained to potential investors, so they have a clear indication of what they are viewing. Knowing how the pro forma documents are compiled and what is left out is also critical when comparing different pro forma statements. Understanding this methodology and the decisions behind it will enable accurate comparisons and information to investors.

Be advised that issuing pro forma financial statements to the public can be problematic, especially since the pro forma statements and the GAAP statements can vary so widely. Investors should be cautious when evaluating these types of statements because they present a considerably more favorable picture of the business.

Documents in Pro Forma Financial Statements

There are three main documents in pro forma financial statements: balance sheets, income statements, and statements of cash flow. Of the four main financial statements, only the statement of changes in equity is not used in pro forma. Further, the other three main financial statements are amended to project for the specific scenario, making them pro forma.

For publicly-held companies, the SEC requires an introductory paragraph showing the proposed transactions, the company, the period covered, and what the pro forma information describes. The SEC also requires the pro forma balance sheet, pro forma income statement(s), and explanatory notes that provide adjustment justifications and pertinent detail. The statement of cash flow is not required. The pro forma financial information should be presented in columns and show the condensed historical amounts, the pro forma adjustments, and the pro forma amounts. GAAP-conforming financial statements must be included with pro forma submissions.

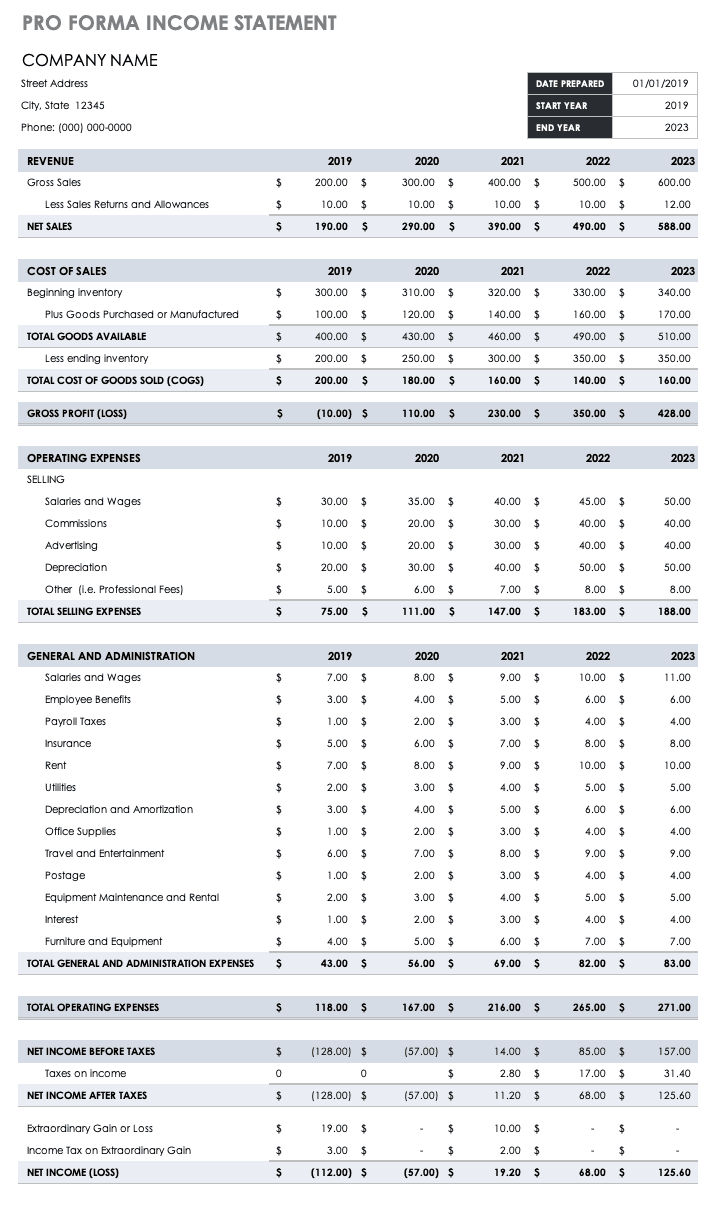

Pro Forma Income Statement

Pro forma income statements, also called pro forma profit and loss (pro forma P&L), are projections based on your past income statements. Regular income statements, sometimes called statement of financial performance, are exacting, in that they reflect the exact income figures your company had in past years. The pro forma income statements considers past data, but its projections reflect the addition or subtraction of events or things. These statements are vulnerable to inaccuracies and changes.

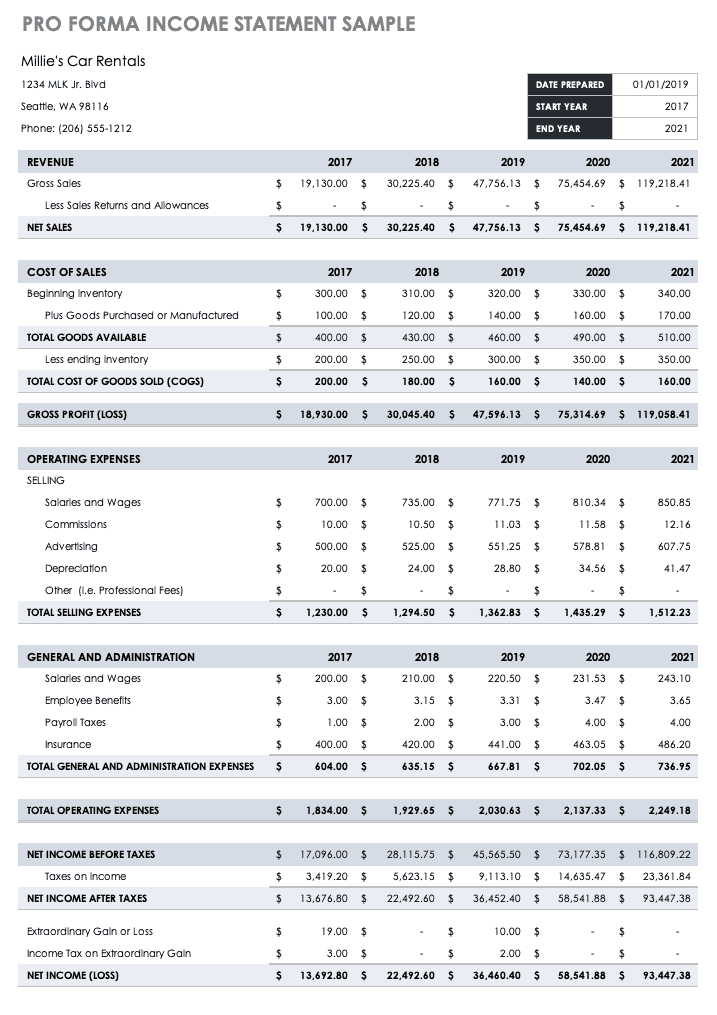

Pro forma income statements usually project a minimum of three years, whereas regular income statements may just be the year prior or based upon a lender’s request. According to the SEC, when required for public companies, pro forma income statements are required for the fiscal year, but not for interim periods. However, for all regular income statements presented in a filing, there must also be a pro forma statement. Use this pro forma income statement template to create your own. This form may also be used for corporate retail or wholesale companies.

Download Pro Forma Income Statement Template

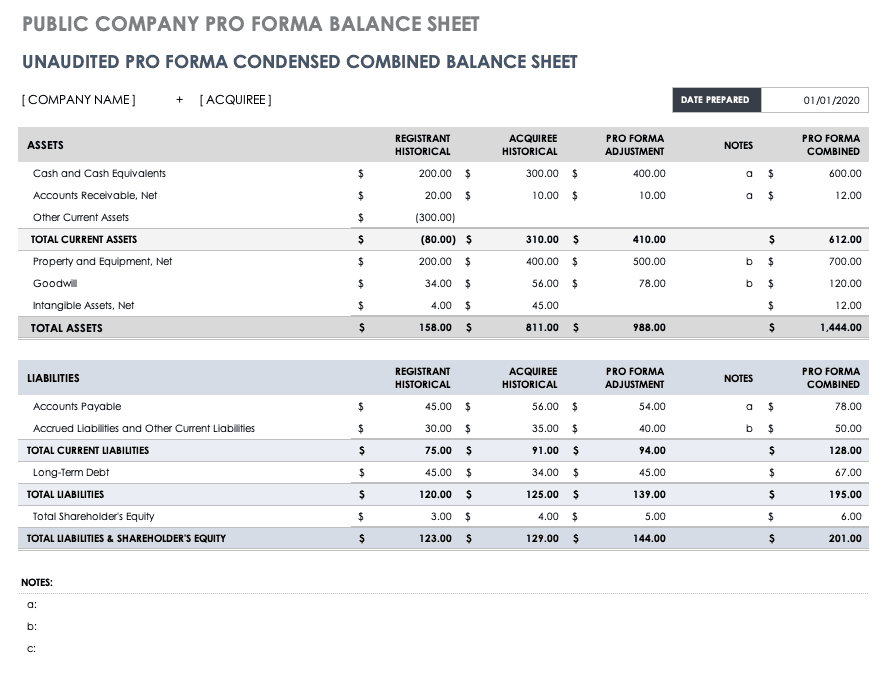

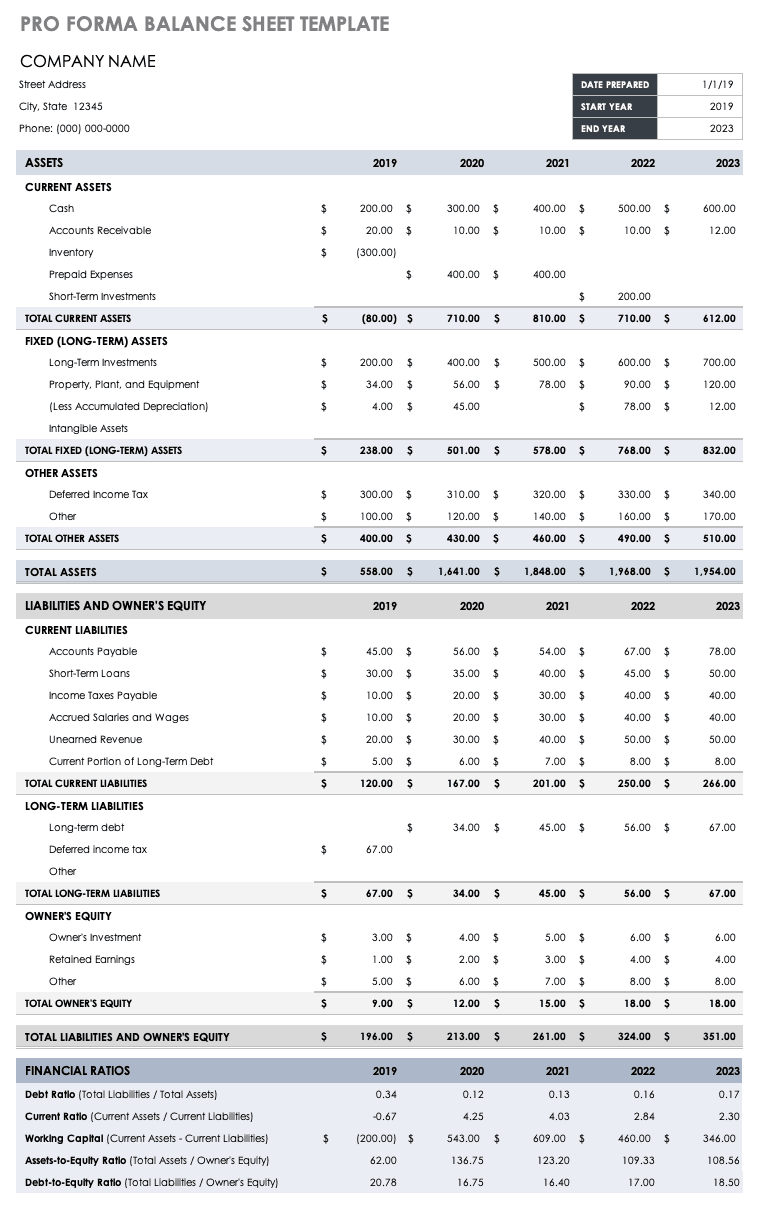

Pro Forma Balance Sheet

A pro forma balance sheet is a comparison of a business’ assets and liabilities. It provides a snapshot in time of the company’s finances. The pro forma part of the balance sheet is a projection that looks ahead, assuming certain things will occur. Pro forma balance sheets are difficult to compile, but banks generally ask for them and they are important for showing your potential financial picture. They can show the projection of what money will be tied up in receivables, equipment, and inventory. Further, they can represent if your company could run out of money, and how much is necessary to keep it afloat. If your company has a high debt-to-equity ratio, it will show on the balance sheet. Use the balance sheet template below to create your own balance sheet. This pro forma balance sheet can also be used for corporate retail or wholesale businesses.

Download Pro Forma Balance Sheet

According to the SEC, for public companies, a pro forma balance sheet should have the same dates, plus one year from the last submitted balance sheet. If interim period balance sheets were submitted, the company should pick up from where they left off. If it is an annual period, the document should also align with the company’s filed GAAP-approved financial statements.

Often, the difference between a past balance sheet and a pro forma balance sheet is that the pro forma balance sheet reports additional periods, sometimes even interim figures. Public companies that prefer to use a condensed combined balance sheet can use this template to create their own condensed balance sheet. A normal balance sheet covers two years, but it is reasonable for a pro forma balance sheet to cover four years of operations.

Download Public Company Pro Forma Balance Sheet Template

Pro Forma Statements of Cash Flow

Statements of cash flow, or cash flow statements, measure the sources of a company’s cash and how it uses that cash over the stated period. Pro forma statements of cash flow estimate how much cash inflow and outflow is expected in one or more future periods. Often requested by banks, they may also be prepared as a part of the annual budgeting or forecast and estimate where cash shortages may occur in order to obtain additional funding. In the case of estimated cash overages, the company can produce a plan for investment. Arguably, the statement of cash flow is the most important of the pro forma documents. If the pro forma balance sheet and income statements lead to a statement of cash flow that shows inadequate funds for what management has planned, the other documents will be invalid and may need to be reworked.

There are several methods to prepare a pro forma cash flow document, relative to the forecasting periods:

Short Term: A cash flow statement that represents a period of weeks, based on outstanding invoices and cash payments for existing accounts payable. This is considered the most accurate forecast.

Medium Term: Estimate the revenue from things that have not been billed yet by using the order backlog and the cash receipts for the next few months. The expenses from this time are also translated into cash payments.

Long Term: Budgeted revenue and expenses are translated to payments, costs, and cash receipts. This is the least accurate projection.

In the annual averages, the figures should not vary significantly. However, the information is affected by outstanding estimated days of sales, or the average number of days that payment has not been made by the customers. The closer the projection is to the actual numbers reported, the more accurate it is. Further, if a company has a stable order backlog, the pro forma statement of cash flow is more accurate. Having knowledge of short-term sales sources help as well. Finally, and regardless of its relative accuracy, a pro forma statement of cash flow forces management to think about the future expected cash flow and whether it is enough.

Use the templates found here to create your own cash flow statement forecast. Change the dates and time periods to reflect the projection you need to create. This form may also be used for corporate retail or wholesale companies.

The Introductory Paragraph

If your company must produce an introductory paragraph with its pro forma documents, it should describe the content of your pro forma documents. This means that it should define the transaction, the entities involved, and the periods of time. In this paragraph, you should offer a high-level explanation of the limitations and assumptions the pro forma documents were produced under. For example, if your company recently acquired or dispensed with another company, the assumptions would be the changes in finance expected. The limitations should discuss the challenges of predicting the financial future of a company.

Explanatory Notes

The assumptions behind these adjustments should be explained in the explanatory notes, and the explanatory notes should be referenced in the column the adjustment is made. Explanatory notes are used to add explanations or more information in financial documents that explain the content. (These are put into the explanatory notes, or sometimes listed as references, because they would make the main content too long or awkward to read.)

Pro Forma Earnings Per Share

Pro forma earnings per share (EPS) are calculated by dividing a firm’s net income (and any adjustments) by its weighted shares outstanding, plus any new shares issued due to an acquisition. These are changes to the expected results of operations. This metric determines the financial outcomes of any acquisition or merger and tells the parent company whether the transaction will be accretive (good) or dilutive (bad) to the financial state of the company. Pro forma EPS are calculated in the pro forma income statement, but the figure is also used in the pro forma balance sheet and the pro forma cash flow statement, when necessary. According to the SEC, when the dividends from stock exceed or are planned to exceed the current earnings, the EPS must be calculated. The SEC assumes that that proceeds from any additional shares will be used to fund dividends.

Pro Forma Adjustments

When your financial statements are put into pro forma financial statements, you adjust material charges, credits, and tax effects to the transactions. In other words, you get an idea of what your financial results would have been if the event had already occurred. These are factually supported by the data from the original financial statements.

It is important to disclose how the adjustments are made on pro forma financial statements. Below is the guidance that the SEC offers about making the adjustments:

Directly Attributable: Each adjustment on the financial statements must precisely correlate to the transaction or event from the original financial statements, and then describe how it is changed.

Continuing Impact on the Registrant: The SEC assumes that any adjustments to the financial statements reflect changes that are not temporary. The goal is to find the stream of earnings from core operations, which can be used to forecast. The adjustments you make for forecasting must impact your company for a minimum of one year. Non-recurring events, such as a one-time, big order for goods should be placed in the pro forma balance sheet as an adjustment to the retained earnings, but would be inappropriate in the pro forma income statement. In other words, you need to point out that the event or purchase is not a trend and therefore, that you cannot forecast based on it.

Factually Supportable: In order to consider adjustments, you must provide existing, factual documentation, such as contracts, letters of intent, or completed transactions. For example, management’s plans to revamp the business section and their estimated costs may not be considered factual support. Letters of intent from vendors for this project may be considered factual evidence.

Getting Auditors Involved

Even public companies are not required to get their pro forma document audited by an independent auditor, according to the SEC. However, to comply with professional auditing standards, the documents can be audited at the request of the company or a third party. The SEC guides auditors to ensure that they do not take on too much responsibility for the company’s claims. Whether in an assurance that the company is financially sound, also known as a comfort letter, or through a compilation letter, the auditor is only responsible for ensuring the financial statements are prepared correctly. The auditor is not responsible for whether the statements are accurate and honestly prepared, but rather to ensure that there are no material errors, such as mathematical errors, oversights, inadequate disclosures, and clerical mistakes. The company’s management is responsible for the documents’ overall validity.

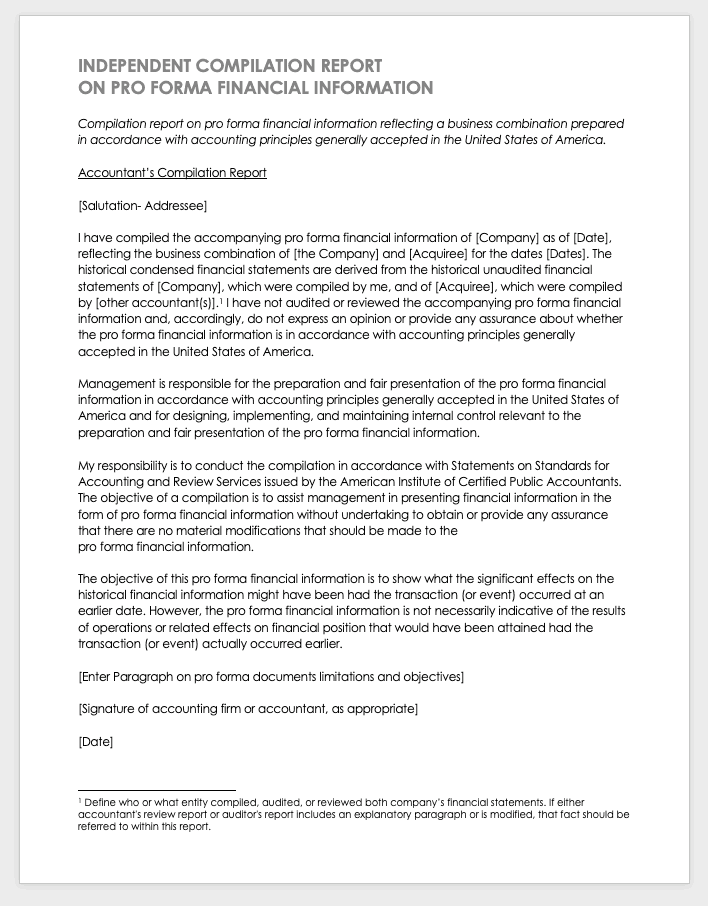

Accountants who prepare companies’ pro forma financial statements are bound by certain requirements, as per the American Institute of Certified Public Accountants (AICPA)’s Statements on Standards for Accounting and Review Services (SSARSs). The SSARSs say that the auditor promises no material modification to the historical financial documents and understands that they are simply showing changes to the company’s financial picture based on a transaction or event using adjustments. They must also ensure they label all pro forma information as such, to avoid confusion with historical information, and list the specific assumptions and uncertainties about them they are making.

The conditions accountants take on include the notation that they may be associated with the statements’ outcomes (so they should consider how the information may be used) and to also submit a compilation report alongside the prepared documents. They are warned that they must have the historical financial information (not just condensed information) alongside their preparation, and that those statements should have been compiled, reviewed, or audited.

To ensure everyone is on the same page, the auditor and the organization’s management should write an understanding of the services being provided. These may include the following:

The objective of pro forma documents is to help management present their information.

The auditor is not responsible if the company made material modifications to the finance information.

Management is ultimately responsible for the pro forma information presentation.

Management is responsible for the internal processes used to garner information.

Management is responsible for any fraud.

Management is responsible for the company to obey the law.

Management is responsible for providing all the pertinent information to the auditor.

Management is responsible to ensure that the preparation rules by AICPA are followed.

A compilation is different from a review or audit of pro forma information. The auditor doing the compilation will not render an opinion.

The compilation will not be relied upon to figure out if there has been fraud, errors, or illegal activities.

If any fraud, material errors, or illegal activities are discovered, they may notify management, but are not required to do so if they are not relevant or if the management has already communicated their awareness.

The auditor must report if they are not independent, and the effect that relationship has on their reporting.

Use this Word template to create your own compilation report, as per the AICPA’s guidance.

Download Compilation Report Template — Word

Before an auditor completes a company’s pro forma preparation, they must review the compilation report and consider any material errors and the appropriateness of the reports. Auditors are required to write a compilation report to protect themselves from liability. This report includes the following:

Title: The title should clearly indicate whether the report is a compilation or if the auditor is independent.

Addressee: As appropriate for the company.

Introductory Paragraph: This must include the company identity, that the pro forma information has been compiled, identify the information, specify the date covered, reference the historical financial documents, state that the auditor does not have an opinion of the finance, as well as note the dates of the historical documents (if applicable), and any departures from those statements.

Statement of Management’s Responsibilities: Management, not the auditor, must state that they are ultimately responsible for the outcomes of the pro forma financial statements.

Statement of Accountant’s Responsibilities: The accountant auditor must state that they will conduct the compilation based upon best practices in their industry.

Statement on Compilation Report Objective: This states that there will be no material modifications made to the pro forma statements.

Paragraph on Pro Forma Documents Limitations and Objectives: This is an explanation of the statements’ intent and why they are projections with limits.

Accountant signature: As appropriate.

Report date: As appropriate.

If the accountant is not independent, the report should reflect this. You can address this fact simply with a final paragraph in the compilation reports, and the author may elect to include the reason for the lack of independence. Finally, in each page of the pro forma information, there must be a reference to the compilation report.

How to Create A Pro Forma Income Statement

To start producing your pro forma financial statements, begin with the pro forma income statement. There is a standard approach called “percent of sales forecasting” that gives you the sales or its growth forecast. From there, project the variables with a stable sales relationship using the forecasted sales and the estimated relations. Generically, the income statement includes the following variables:

Sales (or Revenue) - Cost of Goods Sold = Gross Income (or Gross Earnings)

Gross Income (or Gross Sales/Earnings) - Operating Expenses = Operating Income

Operating Income - Depreciation = EBIT

EBIT - Interest Expense = EBT

EBT – Taxes = Net Income (Net Earnings, EAT, Profits)

Whether you start here or elsewhere, sit down with an income statement from the most recent year. Prior to the end of the year, decide how each item on that statement can or should be changed going forward. The final sales and expenses for the current year should be estimated to get ready a pro forma income statement for the following year. Then, do the following:

Calculate pro forma gross profit. You need to consider all the changes that will be coming next year, including new products, promotions, price changes, and new customers. As a simple example, estimate the percent increase you expect for next year’s sales. For example, if you expect a 5% increase in your current sales of $50,000, you calculate $50,000 * 105% = $52,500. Assuming the cost of the item you sell is not increasing, you still need 5% more of the item you sell to meet your goal. Assuming this year’s cost of goods sold (COGS) was $10,000, you will also multiply it by the 105%, so $10,000 * 105% = $10,500.

To get the pro forma gross profit:

$52,500 - $10,500 = $42,000 (your projected gross profit).Calculate pro forma total operating expenses. For pro forma expenses, you should consider every line item and whether it can be cut, and then determine the cost projection increase rate for salaries and expenses. If, for example, your salaries and expenses will increase 3% next year, start by adding both the historical salaries and expenses together and then multiplying that sum 103%, or as an example: ($25,000 + $5,000) *103% = $30,900. Your pro forma salaries next year will be $25,750 and your expenses will be $5,150 for a total of $30,900 in pro forma expenses.

Calculate pro forma net income before taxes. Calculate your pro forma profit before taxes by finding the difference between the pro forma gross profit and the pro forma total expenses. Continuing the example: $42,500 - $30,900 = $11,600 (pro forma profit before taxes).

Calculate pro forma taxes. Take your estimated tax rate, such as 20%, and multiply it by the pro forma profit before taxes. This would be $11,600 * 20% = $2,320 is the tax bill.

Calculate pro forma net income after taxes. In this example, subtract the $2,320 tax bill from the pro forma before taxes profit of $11,600 to give you the pro forma after taxes. This is $11,600 - $2,320 = $9,280 (pro forma profit after taxes).

There are other stable variables that aren’t influenced by sales on the income statement, including operating expenses, depreciation and amortization, and interest expense. The COGS figure does directly vary with sales; if it does not, something is wrong with your numbers. The COGS forecast is the COGS/Sales ratio from several years multiplied by the sales forecast.

Below is a sample of a filled out pro forma income statement:

How to Create a Pro Forma Balance Sheet

Once your pro forma income statement is completed and you have determined the change in retained earnings, transfer it to the pro forma balance sheet. Expect that the current assets and liabilities will vary directly with the sales variance. For the pro forma balance sheet, the variables include the following:

Assets

- Cash

Accounts receivable

Inventory

Prepaid taxes

Marketable securities - total current assets

Gross PP&E (property, plant, and equipment)

Accumulated depreciation

Net PP&E

Land - total assets

Liabilities + Owner’s Equity (Assets – all other liabilities):

- Bank loan

Accounts payable

Wages payable

Taxes payable

Current portion – long term debt - total current liabilities

Long-term debt

Preferred stock

Common stock

Retained earnings - total liabilities + equity

Ideally, the pro forma balance sheet is composed in columns. Here are some notes about the pro forma balance sheet variables:

The cash balance is usually calculated using a model and policy decisions.

The changes for Gross PP&E are also made using policy decisions.

The required new financing is often decided upon by the short-term or long-term debt residuals.

The interest expense comes from the interest-bearing debt.

Net income is affected by the interest expense, which also changes retained earnings, which also affects the amount of interest-bearing debt necessary.

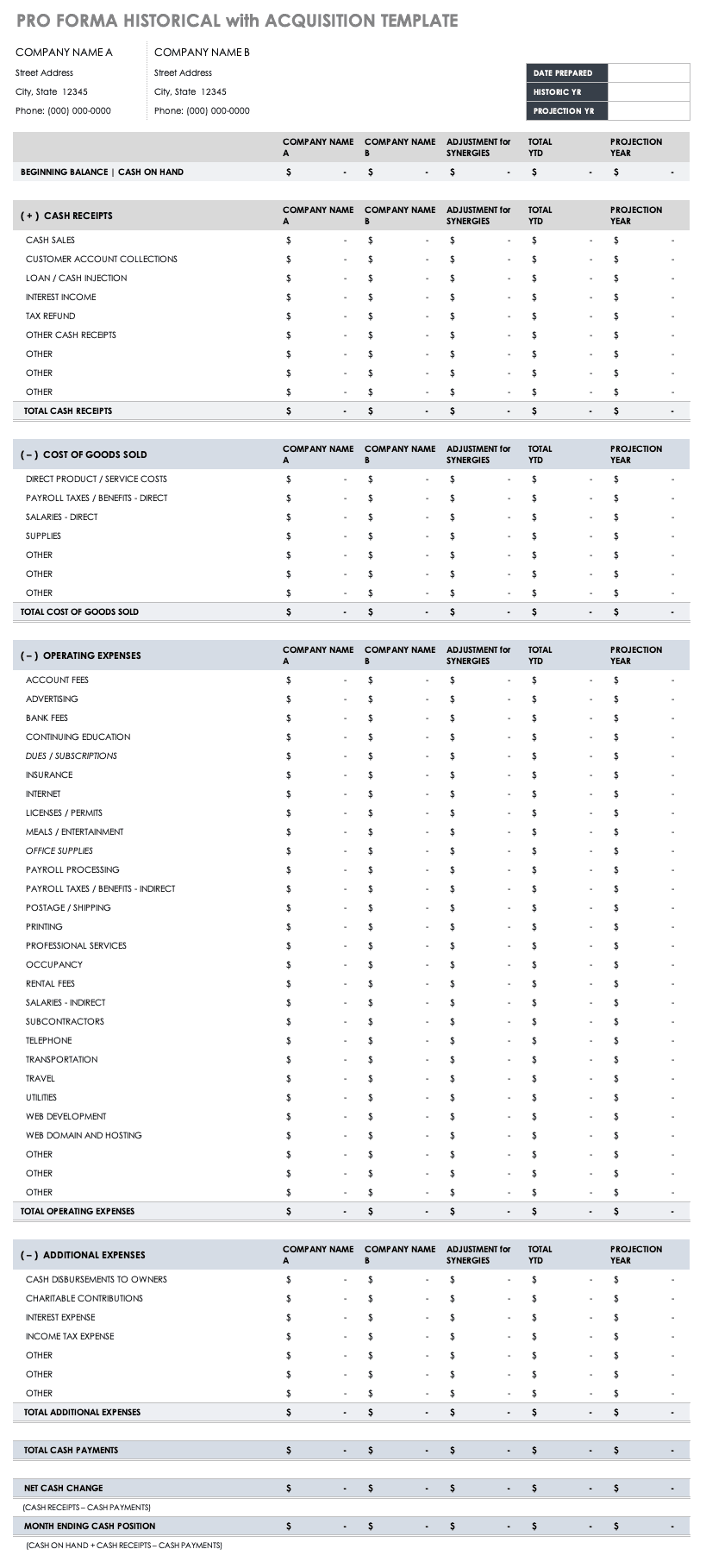

How to Create A Pro Forma Statement of Cash Flow

Once you have completed forecasting both your pro forma income statement and your pro forma balance sheet, you can move on to the pro forma statement of cash flow. Start with the beginning balance, or the cash on hand. From there, add total all the cash receipts you have, including the following:

- Cash sales

- Customer account collections

- Loan/cash injection

- Interest income

- Tax refund

- Other cash receipts

Now, list all the outgoing cash payments. These include adding up all the following, as applicable:

Cost of goods sold (COGS)

Direct product/service costs

Payroll taxes/benefits (direct)

Salaries (direct)

Supplies

Other variables as they pertain to your business

From here, add up all the operating expenses, including the following:

Account fees

Advertising

Bank fees

Continuing education

Dues/subscriptions

Insurance

Internet

Licenses/permits

Meals/entertainment

Office supplies

Payroll processing

Payroll taxes/benefits (indirect)

Postage/shipping

Printing

Professional services

Occupancy

Rental fees

Salaries (indirect)

Subcontractors

Telephone

Transportation

Travel

Utilities

Web development

Web domain and hosting

Add any additional expenses together, as applicable:

Cash disbursements to owners

Charitable contributions

Interest expense

Income tax expense

Other

Other

Other

Finally, calculate your formulas at the bottom of the sheet to get the sums of the analysis. These include Total Cash Payments, Net Cash Change, and Month Ending Cash Position. To calculate each:

Total Cash Payments = Total COGS + Total Operating Expenses + Total Additional Expenses

Net Cash Change = Cash Receipts – Cash Payments

Month Ending Cash Position = Cash on Hand + Cash Receipts – Cash Payments

Linking the Three Pro Forma Financial Statements

The pro forma income statement and the pro forma balance sheet are intimately linked. The pro forma balance sheet and the pro forma income statement must be forecasted together, not separately. The pro forma income statement displays the effect of a given year, while the pro forma balance sheet shows the situation at both the beginning of and time after that year. Between these two forms, the sheet must balance out. Some of the formulas between the two sheets bridge. These include the following:

Change in retained earnings (from balance sheet) = Net income (from income statement) – Dividends

Interest Expense (from income statement) = Interest Rate (from the balance sheet) * Interest-bearing debt

Some other criteria that cross sheets include the following:

Bank Loans (from balance sheet) goes into the Less interest expense (on the income statement).

Long-term debt (from balance sheet) goes to the Less interest expense (on the income statement).

Change in retained earnings (from income statement) goes to Retained earnings (on balance sheet).

The pro forma income statement equation is:

Change in retained earnings = [Revenue – Operating expenses – Depreciation & Amortization

– (interest bearing debt * interest rate)] * (1- Tax rate) – Dividends

The pro forma balance sheet equation is:

Total assets = accounts payable + wages pay + taxes pay + interest bearing debt + common stock + change in retained earnings

For each of the above equations, the interest-bearing debt is the unknown variable.

Finally, you should link each of your three worksheets together. To do so, make sure you do the following:

Add net income from the income statement to the balance sheet and cash flow statement.

Add back depreciation to capital expenditure, which is arrived at on the cash flow statement. This determines property, plant, and equipment on the balance sheet.

The balance sheet and the cash from finalizing are usually affected by financing activities. Interest from financing is shown on the income statement.

The closing cash balance on the balance sheet is the sum of the last period’s closing cash and the current period’s cash from operations, investing, and financing.

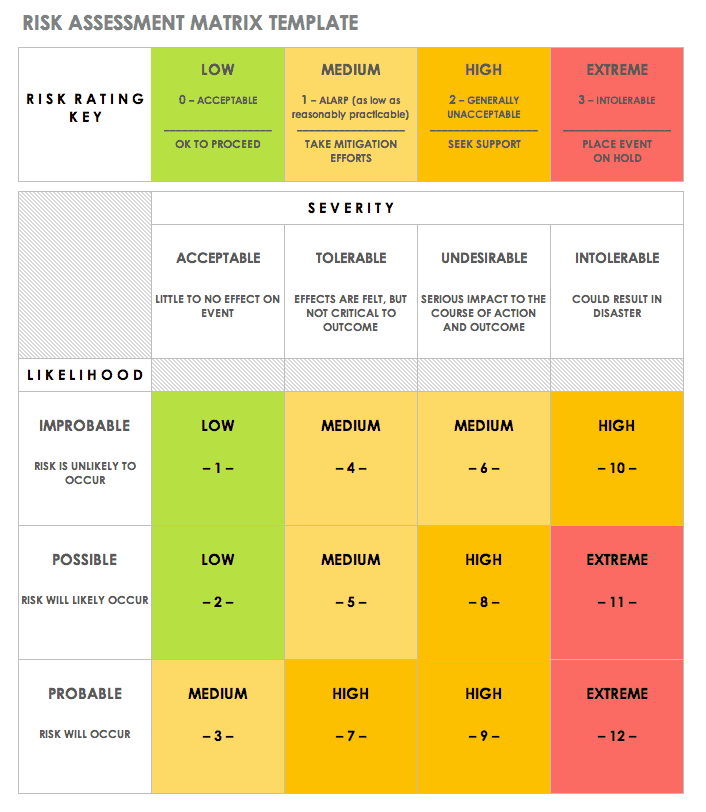

Risk Analysis

In creating your pro forma documents, it is advisable to create multiple sets with different scenarios, especially when their purpose is to help make decisions. In this way, your management team (or C-suite) has all the information they need to make informed decisions. If you enable them, they have the best and worst-case scenarios that review the fiscal impact of their decisions and possible ways to mitigate risk. For more information on conducting risk analyses and the free templates to do so, see “All the Risk Assessment Matrix Templates You Need.” As an example, your team might need to decide between the acquisition of two separate businesses. You could deliver to them two sets of pro forma financial statements, and two risk assessment templates to use to discover their best option.

Download Risk Assessment Matrix Template

Excel | Word | PDF | Smartsheet

Other Types of Pro Forma Financial Statement Templates

There are several other types of templates that could be helpful for a business other than the ones already presented here. There are many different periods that could be covered, as well as the different purposes for the pro forma financial statements.

Historical with Acquisition Pro Forma Template

This projection looks backward (at one or more years) at another company’s financial statements. For the same period(s), it also looks at the business they are acquiring. Using this combination, the projections shows how they would have done together. This calculation gives you the the net acquisition costs. This type of projection could be shorter term (from the beginning of the current fiscal year). Use this free template to create your own historical with acquisition pro forma documents.

Download Historical with Acquisition Pro Forma Template — Excel

Investment Pro Forma Projection

For cases in which your company is specifically seeking funding, you want to show your potential investors how the company’s financial results will change with their investment. There may be several sets of these pro forma documents, each based on different potential investment amounts, or just one based on what you think you need. For this projection, you need to determine where in your company the investments would be parlayed. This can be either a fairly simple or complex process. For example, you may be able to add the investment onto the balance sheet under the cash row in the historical with acquisition pro forma template, or you may have to divide the investment under multiple rows. Check the templates in this guide to determine which is right for you to create your own.

Additional Terms Related to Pro Forma:

There are several terms to relate to pro forma and the finance concepts around it. These include the following:

Financial or Accounting Ratios: These figures are calculated from financial document figures, and they give a snapshot of a firm’s financial status and enable comparisons to other firms. Below are five frequently used financial ratios:

Debt-to-Equity Ratio: Total liabilities / stockholder’s equity

Current Ratio: Current assets / current liabilities

Quick Ratio: (Current assets – Inventories) / current liabilities

Return on Equity (ROE) Ratio: Net income / shareholder’s equity

Net Profit Margin: Net profit / net sales

- Pro-rata: This term describes a proportionate allocation. Used for dividend payments, insurance premiums, and interest rates, pro rata calculations determine the fractional payment from the whole. For example, in dividend payments each investor is paid according to their number of shares and based on the company’s number of shares outstanding. If the company has 400 shares outstanding at $2 per share, the maximum amount of dividends paid will be $800. The whole is $800. If one shareholder has 201 shares, their dividend will be:

(the number of shares / the number of shares outstanding) * the total dividend payment

In this case: (201/400) * $800 = $402 Pro bono: This comes from the latin term “pro bono publico,” meaning to work for the public good. It is voluntary work of no cost to the recipient. It often refers to free services from a professional to clients without the financial means to pay for them.

Quid pro quo: This term is a Latin phrase that means “something for something.” It occurs when two participants mutually agree to exchange something for something else. In business, this can take the form of goods, services, or tradable assets. These have also been called “favor for favor” arrangements, and the term can be used to describe unethical behavior such as the exchange of financial backing for political favors.

A quid pro quo contribution: This is a charitable contribution, but with one major difference. In a regular charitable contribution, the donor does not receive anything in return for their donation. In this type of donation, the Internal Revenue Service (IRS) allows the donor to deduct the entirety of their donation that is eligible. In a quid pro quo contribution, the donor receives something for their gift from the charity. The difference between what they have donated and the value of what they receive is the deductible amount. For example, a parent donates $500 at the school charity event to help them start a garden. In return, she receives a $50 gift card to the local grocery store. This is a quid pro quo contribution of which she may only claim $450 of as contributions for the tax year.

Budgeting: The plan created to balance expenses with revenue. The creation of this plan enables people and businesses to know whether they can afford to do the things they need to do and purchase the things they need. Following a budget ensures that people stay out of debt, can save, and pay their bills. Traditional budgets track expenses, payments to eliminate debt, and building an emergency fund as a buffer. Budgets should be compiled and reevaluated regularly.

Interim financial statements: These cover a period of less than one-year, interim financial statements may be issued for quarterly periods or any period. They usually contain the same documents that would be found in an annual statement, such as income statements, balance sheets, and statement of cash follows, and should match by line items. Some interim financial statements may be reviewed, such as in publicly-held companies, but they are not generally audited. Differences between interim and annual financial statements are in the following:

- Disclosures: Some disclosures are not required in interim financial statements, or may be presented as summaries.

Accrual basis: Accrued expenses may be reported within one reporting period or spread over multiple reporting periods. This variance can cause inconsistencies when interim reports are compared and should be defined for reviewers.

Seasonality: Season trends not seen in annual statements may be revealed by interim statements. These may be helpful in seeing seasons of major profit and loss.

Compilation: When financial statements are prepared or compiled by an outside agent, they are referred to as a compilation. The outside agent does not provide auditing or assurance services, just puts the data into financial statements. This type of service is less expensive than review or auditing services.

Notes to the financial statements: Also called the footnotes, and sometimes in the explanatory notes, notes to the financial statements explain how a company arrives at its numbers and any possible irregularities or inconsistencies. These are the details that explain the methodology, what decisions were made, and why to clarify the reports.

External financial statements: When financial statements are distributed to people or organizations not involved in the company’s operations, they are considered external financial statements. They are often compared to other companies or to previously released external financial statements and follow GAAP. A complete set includes the following:

Income statement

Balance sheet

Statement of cash flows

Statement of comprehensive income

Statement of stockholder equity

Footnotes

Common-size financial statements: Common size financial statements display all the items as percentages of the common base figure instead of as numerical figures, enabling comparisons between different companies or periods. Though most companies do not report in this way as it is not required, this type of reporting decreases bias.

Free Cash Flow Analysis: A free cash flow (FCF) analysis calculates the amount of cash a company can put aside after it has paid its expenses at the end of an accounting period. Free cash flow shows a company’s ability to grow internally give profit back to its shareholders. The formula for assessing free cash flow is:

Net cash flow – capital expenditures - dividends

OR

(Net income + amortization + depreciation + deferred taxes) – capital expenditures - dividendsVariance Analysis: A variance analysis clarifies the difference between expected and actual results. Analyzing variances can improve operational efficiency. Using budgets as estimates and actual costs, the differences (called variances) are calculated. The point of variance analysis is to determine if the project or business forecasts were accurate and to adjust based on this knowledge. For more information on cost variance and how to calculate it specifically for projects, see “Hacking the PMP: Studying Cost Variance.”

Discover a Better Way to Manage Pro Forma Statements and Finance Operations

Empower your people to go above and beyond with a flexible platform designed to match the needs of your team — and adapt as those needs change.

The Smartsheet platform makes it easy to plan, capture, manage, and report on work from anywhere, helping your team be more effective and get more done. Report on key metrics and get real-time visibility into work as it happens with roll-up reports, dashboards, and automated workflows built to keep your team connected and informed.

When teams have clarity into the work getting done, there’s no telling how much more they can accomplish in the same amount of time. Try Smartsheet for free, today.